E-File HVUT Form 2290 Online Process

E-File HVUT Form 2290Form 2290 E-filing Process

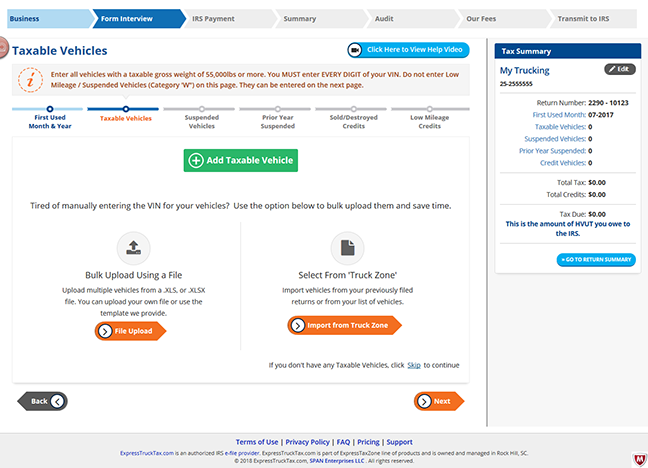

Step 3: Add Vehicles

Step 1

Add Business

Step 2

Choose First Used Month

Step 3

Add Vehicles

Step 4

Make IRS Payment

Step 5

Review Errors

Step 6

Payment Options

Step 7

Transmit to IRS

Step 8

Receive Schedule 1

When you file Form 2290 online, you may add any and all necessary vehicles, including sold/destroyed, suspended, and low mileage vehicles. Suspended and prior year suspended vehicles are vehicles that have not exceeded the 5,000 mile threshold (or 7,500 miles for agricultural vehicles). Sold/destroyed credits are allowed for vehicles that were stolen, sold, or destroyed in the tax year.

We offer a bulk upload feature to accommodate our clients that need to e-file large quantities of trucks. The filer will download an Excel file, complete the necessary fields, and upload it back into the system.

Keeping up with a lot of trucks is hard, but the Truck Zone makes it much easier. All of your vehicles are managed from the Truck Zone and information about the vehicles is saved for future use.