E-File HVUT Form 2290 Online Process

E-File HVUT Form 2290Form 2290 E-filing Process

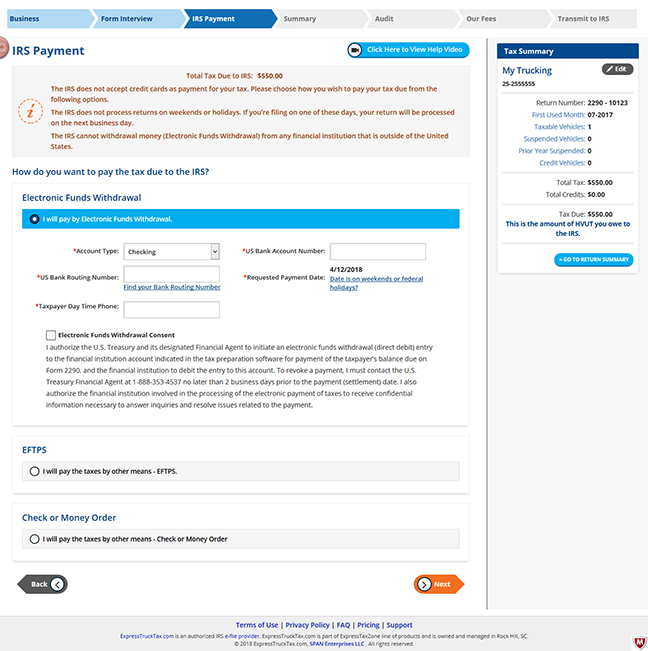

Step 3: Make HVUT Payment To The IRS

Step 1

Add Business

Step 2

Choose First Used Month

Step 3

Make HVUT Payment To The IRS

Step 4

Transmit Form 2290 to IRS

Whatever HVUT amount you owe, there are several payment methods currently accepted by the IRS. These include: Electronic Funds Withdrawal (EFW), Electronic Federal Tax Payment System (EFTPS), Credit or Debit Card or you can mail a Check or Money Order directly to the IRS.

The direct debit or EFW (Electronic Funds Withdrawal), the IRS pulls money directly from your account. If EFW is chosen, the IRS will not process the payment on weekends or federal holidays.

Electronic Federal Tax Payment System, is similar to the EFW but requires an account to be set up at EFTPS.gov. Once enrolled into EFTPS, you will receive a pin number from the IRS within 5-7 business days. You will not be able to submit an EFTPS payment until you receive your pin number.

Credit or Debit Card: Starting in July 2018 the IRS will allow you to pay 2290 with a credit card or debit card!

A convenience fee does apply when e-filing with any third party provider. For more information on credit or debit card payments, go to IRS.gov/PayByCard.

Check or Money orders are payments sent to the IRS which are safer than cash and less complex than the previously mentioned payment methods. If you pay your HVUT by mailing a check or money order to the IRS, you must include payment voucher, 2290V with your payment.