2290 Amendments and Form 8849

- General Queries on Form 2290

- Form 2290 Due Date

- E-filing 2290 Information

- 2290 Amendments & Form 8849

- Pricing and Payment

Can I E-File a VIN correction?

Yes! Found exclusively at ExpressTruckTax.com, Form 2290 VIN corrections can now be E-Filed with the IRS.

Regardless of how you originally filed your return, you can E-File your VIN correction with ExpressTruckTax.com for FREE.

I made a mistake on my 2290. Can I fix it online?

Absolutely. You may file Form 2290 Amendments and

VIN corretions directly through our system.

My Taxable Gross Weight increased. How do I update my 2290?

You can update your taxable gross weight category quickly and easily by E-Filing a Form 2290 Amendment.

The IRS rejected my return. How do I correct my return?

Occasionally, the IRS may reject a return for various reasons. If your return is rejected, our system will list the specific reason for rejection and provide and clearly display how the error can be fixed.

Once fixed, you may retransmit your return for no additional charge.

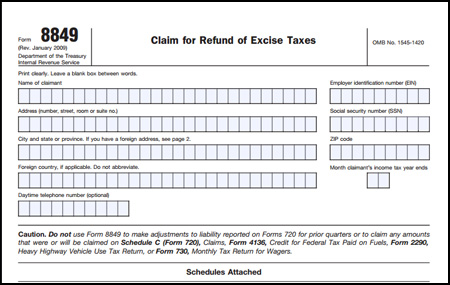

What is a Form 8849?

Form 8849 is the “Claim for Refund of Excise Taxes” form. The Form 8849 Schedule 6 can be filed

to claim a refund or credit of heavy vehicle use taxes previously paid.

If you paid Heavy Vehicle Use Taxes (Form 2290) last year but did not exceed the mileage use limit,

we can automatically generate a Form 8849 or even apply a credit directly to any taxes due

during the current tax period.

I drove my truck less than 5000 miles last year. Can I get a IRS refund or credit for the taxes I paid last year?

Absolutely! If you paid HVUT (Form 2290) taxes last year on a vehicle that traveled 5000 miles or less (7500 miles for agricultural vehicles) then you qualify for a refund of the taxes paid.

You may either file a Form 8849 to apply for the refund or apply the earned tax credit directly to the current year tax due. Whichever method you choose, you can do it directly from our system.